As the shift in global energy approaches a rapid pace, the area of energy storage has transformed from a niche influenced by policies to a powerful market driver. For affluent individuals in search of unique investment opportunities, the sector's genuine financial potential resides not in the typical battery production, but rather in specialized areas that fuse technological advancements, existing market voids, and interrelated value.

Think about ultra-high-capacity solid-state battery systems designed specifically for luxury private homes, private aircraft, and superyachts—innovations that deliver unparalleled energy density, quick recharging, and durability, addressing a need overlooked by mainstream producers concentrated on electric cars. These custom storage solutions not only supply dependable, off-grid energy for the affluent’s lifestyle properties but additionally function as unique investment opportunities, with profits linked to the rarity of advanced technology and the increasing interest in energy self-sufficiency among wealthy individuals.

Virtual Power Plant Aggregation

In addition to expansive storage initiatives, virtual power plants (VPPs) that unify dispersed storage resources into a cohesive "cloud power plant" are altering the energy market landscape. Aggregators using artificial intelligence techniques to enhance load distribution and engage in spot market trading and supportive services have developed a diversified revenue framework, significantly minimizing income fluctuations while capitalizing on carbon asset benefits.

Sodium-Ion Battery Ecosystems

Due to lithium resource limitations, sodium-ion batteries have become a viable alternative, featuring plentiful raw materials and prolonged lifecycle. Investing in upstream sodium-derived materials or in early-phase producers concentrated on industrialization within low-to-medium energy storage applications provides an entry into a quickly developing field with substantial substitution opportunities.

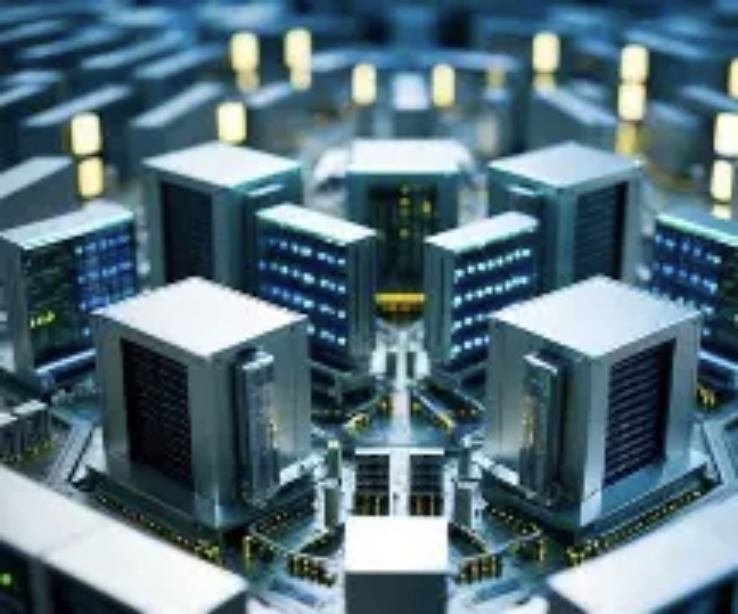

Tech Integration for Data Centers

The increasing demand for computational power has positioned energy storage as essential support for data centers. Tailored storage solutions that merge solid-state batteries with intelligent energy management not only guarantee a reliable power supply but also minimize carbon emissions, appealing to both technology corporations and institutional investors due to their high-value niche status.

International markets such as Europe and the Middle East present significant storage demands alongside stringent regulatory frameworks. Regionally based technical service facilities, certification consulting, and bespoke system designs for local grids offer profitable possibilities, especially for entities possessing cross-border compliance and technical adaptability skills.

Energy Management for Luxury Real Estate

Luxury residential and commercial properties are progressively integrating distributed storage systems alongside rooftop solar energy. Customized energy solutions that improve energy independence, provide backup power, and work in harmony with smart home technologies cater to the eco-luxury movement, establishing a specialized market for high-margin services and installations.

ESG-Aligned Operational Assets

Investing in operational storage facilities with definitive ESG qualifications, such as those serving remote communities or facilitating renewable energy incorporation, generates consistent income through capacity leasing and tariff arbitrage while aligning with global sustainable investment movements, thereby fortifying portfolio stability.

For astute investors, the pathway to tapping into the financial potential of energy storage is to explore beyond the conventional. By concentrating on these specialized areas that merge technological innovation, localization, and sustainability, one can gain a strategic advantage in a sector destined for enduring expansion.